Video Transcript

This video is going to be all about a 1 step budget plan. That’s right, 1 step!

When most people think about budgeting they kind of recoil a little bit and go “uh, this is a lot of work, it takes too much time, I don’t wanna do it” and then they don’t do it. So I created a super simple 1 step budget plan. Why? Because if it’s simple (hopefully) people will do it. Lots of times when you hear advice to create a budget they’ll start with things like “okay, take out all your bank statements, and all your credit card statements for the last 6 months, and go through them all, and figure out how much you spend in each of these categories and add it up” that’s a lot of work! I like numbers and that isn’t something I’d want to do. That’s why I wanted to keep it simple. 1 step.

And the second part why is because… I’ll let you in on a little secret… when it comes to creating a budget, especially your first budget, it’s going to be wrong. No matter what you do, your first budget is going to be wrong. So just get it done and get it over with and go forward with it. It’ll probably take you at least 3 months to get a budget that is starting to make sense. So if it’s going to be wrong… If your first budget is going to be wrong anyways… why not do a fast wrong budget instead of a very time consuming wrong budget that you never actually end up doing. Hence the 1 step budget.

How do you do a 1 step budget? Well in my 1 step budget the only number you need to know is your income. And if you don’t know exactly what your income is, that’s fine, then come up with something that is close, because we are just trying to get that first budget out of the way and get it done.

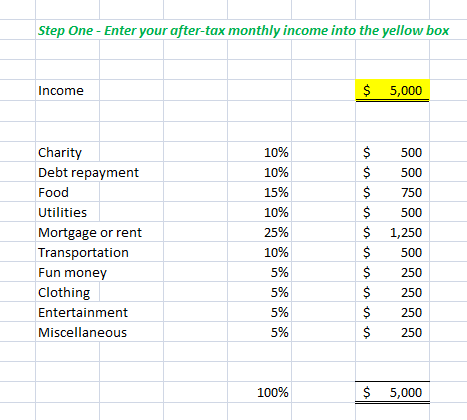

I created an excel spreadsheet that’ll do that calculation for you, so if you go over to hyska.com you can download the spreadsheet. If I knew how to just put it on my website I would but I’m not that “tech” yet but it’s there to download. Please go and check it out and I promise you, all you need to do is enter one number. And then what? It just takes standard percentages and allocates it for the different things in your life. And I will go through those percentages. I just have to pull them up here. (In case you don’t have the spreadsheet and in case you want to figure out for yourself)

What you do is:

– you start with your income

– and then you take 10% of it and we say that that’s for charity

– then we take the next 10% and it goes towards debt repayment

– then we take 15% and that goes towards food

– then we take 10% and put that towards utilities

– we take 25% and put it towards mortgage or rent

– and we take 10% and put it towards vehicle expenses or transportation expenses

– 5% goes towards fun money! Woo hoo! We actually get to have fun even though we are living on a budget. (And that is actually a very important part. If you want to be able to stick to your budget you have to have some sort of fun money, but that might be a topic for anther video)

– 5% is going to go towards clothing

– 5% towards entertainment

– And then 5% towards miscellaneous (because I guarantee you, stuff is going to come up that you hadn’t thought of. Even after years of budgeting stuff still comes up in ours that we didn’t think of).

So that’s kind of the low down on that. And you’ll enter your income number in and it will spit out these numbers. And you can just roll with that.

Now you may look at it and some may be very obviously wrong for you and you can make some adjustments in there. But the most important part of this budget is that no matter what adjustments you do, at the end of the day, the expenses in your budget cannot be more than you income. So if you’re looking at it and are going “oh, my mortgage is way higher than 25%”… well if you want to make that number higher than some other number needs to go down so that you’ll end up with what’s called a zero-based budget. I want to do another video with more detail on how to do a zero-based budget (and things like that). But very high level, this will create you first budget. And if some of your numbers a really, really out of line based on this budget then that may be something for you to spend more time thinking about and that maybe there are some adjustments that you need to make in your life. But I wanted to make it simple, and make it 1 step, so you can just get started. Because like I said, it’s going to take you at least 3 months until you start to get kind of decent at this whole budgeting thing. So just start with something and go with it.

And then now that you have your starting budget, now you’re going to start keeping track of expenses. And there are apps that can do that for you (which I will also talk about in another video) because I just wanted this one to be about how to do a 1 step budget so that anyone can do this.

Your action step for this one is, head over to hyska.com, download the little excel spreadsheet and enter your one number in it and then boom, you have your very first budget!

Tell me what you think about this. Head over to my website and put a comment about what you think of the 1 step budget. And if you have questions I’d be happy to help you, please get in touch. And if you think this can help someone, as always, please share it with anyone you want to. And if this makes you think of more questions then please put a comment and I’d be happy to answer your questions.

That’s if for now.